If you or a family member is injured in an accident, there is a special type of policy called Personal Injury Protection (PIP) that will cover certain injuries. PIP pays for expenses for doctor visits, medications, and lost wages. There are many types of PIP plans available to cover various injuries, from brain damage to spinal cord injuries. Some of the most common injuries covered by PIP plans include whiplash, traumatic brain injury, and spinal cord injuries.

Many people injured in car accidents also receive PIP benefits.

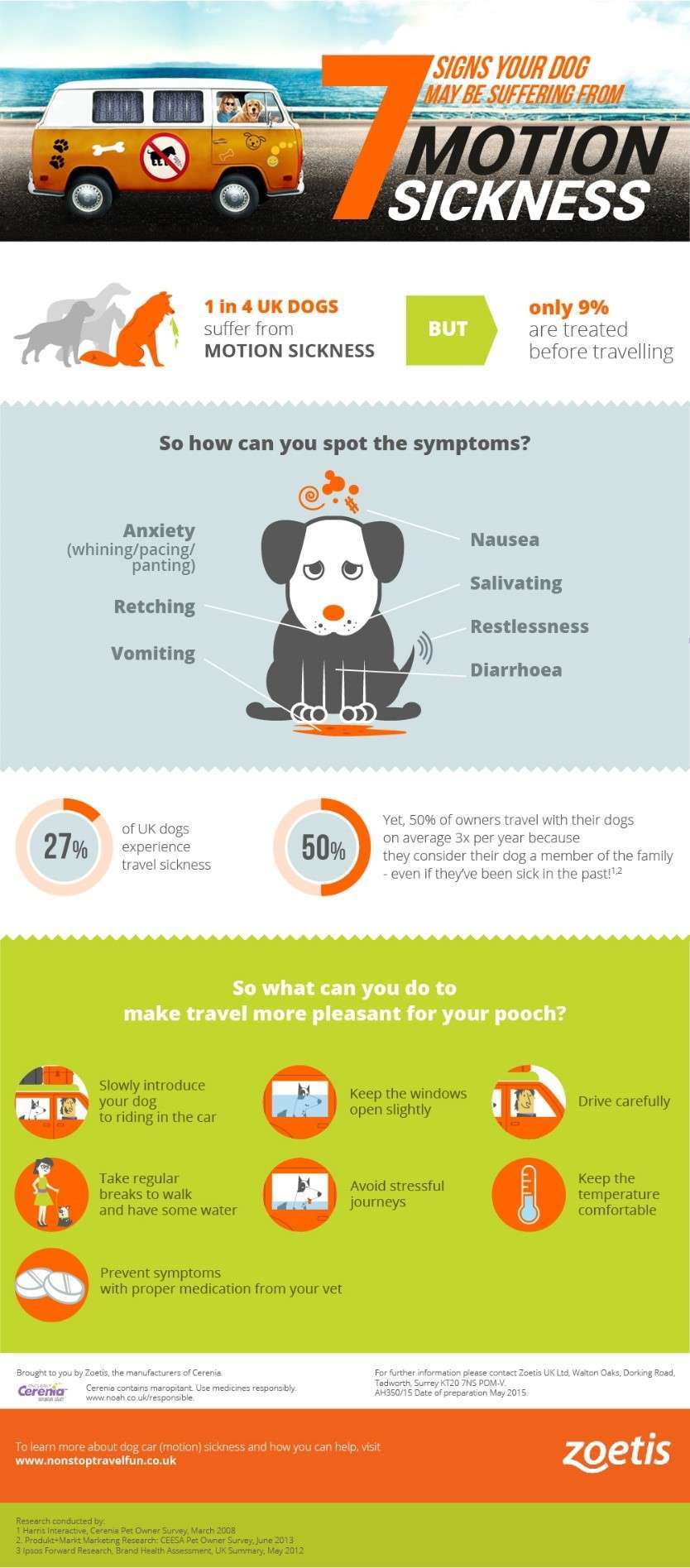

- When your pet gets hurt, you want to have adequate coverage so that you can pay for medical expenses and provide pain and suffering for your pet.

- If your pet is involved in an accident, you have several options to choose from to determine the level of coverage that you need.

- To determine the extent of your coverage, contact a PPI claims company to discuss your options.

- They will assist you with determining which type of coverage will best meet your needs.

PIP plans are often: provided by veterinarians or other animal health professionals. In the case of a veterinary doctor, the coverage is often through a discount plan that requires payment at the time of service. This is common with younger animals who are not yet trained to participate in physical exams. Other veterinarians will provide this service as part of a negotiated fee with their patients.

You may also want to consider: additional coverage from your pet insurance providers if you have other pets. PIP plans will usually cover your other pets in the same manner that they cover your sick pet. For example, your veterinarian may cover your other dogs or cats under one policy should you have more than one. Again, consult your pet insurance providers to determine the exact details of your coverage and to make sure you understand the limitations of your policy.

One of the most popular optional: add-ons for pet insurance is the coverage of travel expenses. A good number of pet owners will take their pets on vacation in order to witness new sights or to see a new part of the country. If your pet has special needs that require airfare, your pet insurance providers should be able to add this coverage to your policy. This can allow you to enjoy vacations far away from home while still maintaining the health and well being of your beloved pet.

It is also important to remember: that with most plans there is an annual limit to the amount of coverage that can be provided. Your pet insurance provider will be able to advise you on the limits that are appropriate for your pet and the length of time that the coverage will last. There are also many options available to provide for veterinary care and accident expenses. In addition, it is vitally important to keep all of your pet's vaccinations current.

A lack of proper vaccinations or a history of sudden illnesses or accidents can result in significant financial burdens for you and your family.